Here’s something that I firmly believe: Almost anyone can be a millionaire.

It may not be easy. You may have to work much harder than your neighbor. But, you might be surprised at what’s possible once you put your mind to it.

Your journey to a million starts right here.

First, if you’re not signed up Millionaire Habits, my weekly 3-minute newsletter teaching you everything you need to know about becoming a millionaire through simple habits, fix that below.

The Journey Starts with Understanding the Basic Wealth Building Equation

Unless you’re the lucky recipient of a large inheritance (FYI: this is much less common than you probably think), wealth is built the same way for everyone.

The equation looks like this: Wealth = Income + Investments – Lifestyle.

Now, I want to draw your attention to a couple of critical elements.

Notice that “saving money” is not a part of the equation.

Yes, saving money has value. An emergency fund is a great example of the benefit of saving money within the larger wealth-building timeline.

And, notice that your lifestyle is a part of the equation.

In other words:

- income and investments build wealth (over time)

- lifestyle expenses drain wealth

Whatever is left is the wealth that you truly possess.

Wealth is Built Along a Timeline

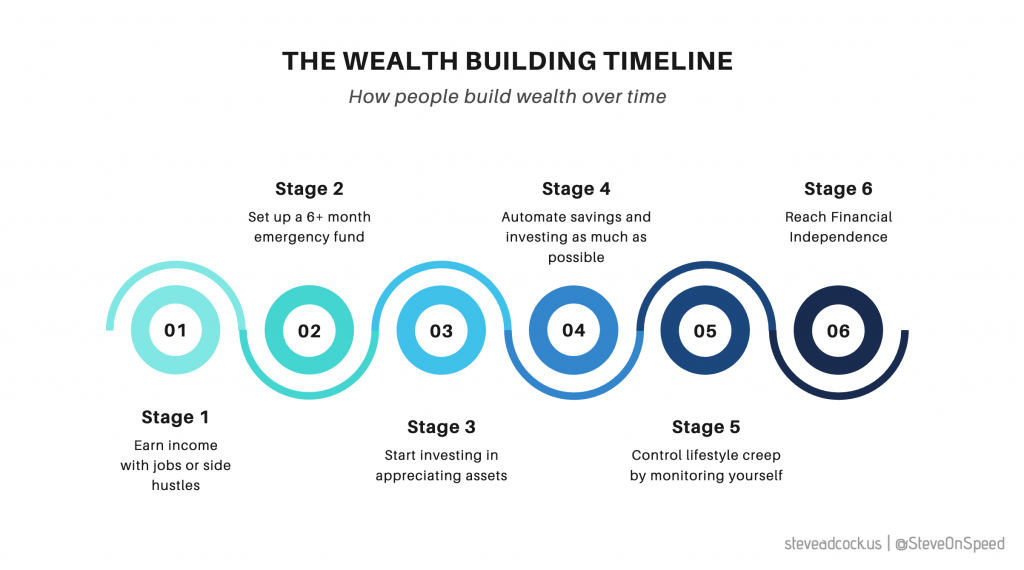

The wealth-building timeline looks like this. Very few of us manage to skip one of these stages and get away with it, by the way. We all go through these six stages.

What do each of these stages mean? Let’s find out.

Stage 1: Earn income with jobs or side hustles. It’s impossible to build wealth without earning an income. The larger the income, the more growth potential.

Note that you don’t need to earn a big salary to achieve financial independence or retire early, though it will take longer to build wealth with smaller salaries. That’s okay. This is a process, not a race.

Stage 2: A 6+ month emergency fund. Building an emergency fund should come before investing – and definitely before spending on things that are not essential to your life. An emergency fund of at least six months means you can endure most financial emergencies, sudden job losses or anything else that necessitates a quick and big cash expense.

If you don’t have an emergency fund, start one today. Start small. Save as much as you can. The key is to start building it NOW.

Stage 3: Start investing in appreciating assets. Over time, investments are what builds wealth. Like I say in my eBook Big Money, there is always a risk associated with investments, but investing over the long haul is how most people build enough wealth to achieve financial freedom.

Stage 4: Automate savings and investing as much as possible. Take the discipline out of the equation by setting up automatic transfers to fund your investments. This is also a good technique to use when building up your emergency fund, and most banks offer recurring money transfers.

If your employer offers a 401(k) or IRA, then use the payroll system to automatically contribute into those retirement account.

Stage 5: Control lifestyle creep by monitoring yourself. Be honest with yourself about how you spend your money. Inspect your bank and credit card statements and understand every expense.

Our lifestyles have a way of expanding as we earn more and more money. This process is called lifestyle creep (or inflation), and it eats away at our wealth. This process is not about being judgmental.

It’s about caring enough about your future to reign yourself in.

Stage 6: Financial independence. Congrats, you’re there! But, don’t let your guard down. It’s possible to fall out of financial independence if we let our lifestyle get too expensive or extravagant.

How do you know when you’ve reached financial independence?

The Trinity 4% study is one of the best ways to give you a ballpark understanding of your relative “level of independence”. Note that it’s far from perfect, and it should NOT be relied upon as a full-proof guarantee that you’ve reached FI. But, I do believe it’s a good guideline.

Remember, Income Does Not Equal Wealth

Too many people fall into the trap of believing that earning a high salary means they are “rich”. Unfortunately, it’s not that simple.

High-income debt is a thing. In fact, it’s a BIG thing.

Here’s the problem: A high income lulls us into a comfortable feeling that we’re building wealth. But unless we are saving and investing a large portion of a big salary, nobody’s getting rich.

The pseudo-affluent are people who earn lots of money and spend the majority of it (on cars, vacations, big homes and pricey jewelry), leaving them close to nothing left over.

The pseudo-affluent generally:

- Earn a high-income, but spend the majority of what they make

- Wear expensive suits or carry Louis Vuitton purses

- Drive high-end luxury or sportscars like BMWs, Porsches, and Mercedes

- Genuinely believe that rich people act rich

If you want to be a millionaire, then you can’t just spend.

Latest posts

- 7 Mistakes First-Time Home Buyers Make (And How to Avoid Them)

Buying a home is a major financial decision, and it’s important to avoid making mistakes that could cost you money in the long run. For instance, buying my first home was one of the biggest mistakes I’ve ever made. Of course, this was also in 2007, the peak of home prices before the epic housing…

Buying a home is a major financial decision, and it’s important to avoid making mistakes that could cost you money in the long run. For instance, buying my first home was one of the biggest mistakes I’ve ever made. Of course, this was also in 2007, the peak of home prices before the epic housing… - Why Health Savings Accounts Are Investment Goldmines

Health Savings Accounts, or HSAs, are a hidden investment vehicle too good to pass up. Once you understand how they work, you’ll probably think so, too. In recent years, healthcare costs have been on the rise, placing a heavy burden on individuals and families. To address this issue, Health Savings Accounts (HSAs) have emerged as…

Health Savings Accounts, or HSAs, are a hidden investment vehicle too good to pass up. Once you understand how they work, you’ll probably think so, too. In recent years, healthcare costs have been on the rise, placing a heavy burden on individuals and families. To address this issue, Health Savings Accounts (HSAs) have emerged as… - Skip Budgeting: How “Pay Yourself First” Works

Hate the idea of budgeting? Guess what? Me too. Believe it or not, you don’t have to track where every cent goes meticulously. The Pay Yourself First method offers a simple and effective strategy to break free from this cycle and take control of your finances. This approach empowers individuals to secure their future and…

Hate the idea of budgeting? Guess what? Me too. Believe it or not, you don’t have to track where every cent goes meticulously. The Pay Yourself First method offers a simple and effective strategy to break free from this cycle and take control of your finances. This approach empowers individuals to secure their future and… - Debt Snowball vs. Debt Avalanche: Which Is Better?

Managing debt can be overwhelming, but choosing the right debt payoff method can make a significant difference in achieving financial freedom. Two popular strategies, the Snowball and Avalanche methods, offer distinct approaches to tackling debt. This article will explore the differences between these methods and help you determine which is better suited to your unique…

Managing debt can be overwhelming, but choosing the right debt payoff method can make a significant difference in achieving financial freedom. Two popular strategies, the Snowball and Avalanche methods, offer distinct approaches to tackling debt. This article will explore the differences between these methods and help you determine which is better suited to your unique… - How to Become a Millionaire as Quickly as Possible

So, you want to be a millionaire? Well, you’re in luck! It’s actually not as hard as you might think. Sure, it takes time and effort, but it’s doable. Here are a few tips to help you become a millionaire as quickly as possible: If you follow these tips, you’ll be well on your way…

So, you want to be a millionaire? Well, you’re in luck! It’s actually not as hard as you might think. Sure, it takes time and effort, but it’s doable. Here are a few tips to help you become a millionaire as quickly as possible: If you follow these tips, you’ll be well on your way…