There’s a LOT of advice about money out there. While some of it is okay, a lot of it (read: most of it) is just plain bad.

Here are the worst pieces of financial advice I have ever heard.

The 15 Worst Pieces of Financial Advice

1: You can’t get rich working a 9 to 5.

I’m proof-positive that’s a lie. With proper money management skills, your 9-to-5 CAN MAKE YOU RICH. It happens all the time. I was able to retire early because of my 9 to 5 job.

The key is putting your money to work for you with every single paycheck. The earlier you start, the earlier you can achieve financial freedom and retire.

Here are 5 ways to build serious wealth with your 9 to 5 job.

- Take advantage of company-sponsored retirement accounts. I always signed up for 401(k) and Roth IRA plans when they were offered, and many of my employers matched 4% of my 401(k) contributions. That’s free money.

- Ask for raises and promotions. You may not always get a “yes”, but sometimes, you just need to ask. I asked four times for raises in my career and got the “yes” three out of the four times.

- Show up every day. Work ethic has a way of improving your “luck”. Be a team player. Do what you say you’re going to do. The bar is set pretty low these days. Showing up is half the battle.

- Switch companies regularly. Every time I moved to a different company, I got a 15 to 20% raise. Taking another position is a great opportunity to ask for more money. In fact, it’s a natural part of the process!

- Avoid bad debts. I never took out high interest loans. I never paid a single dime of interest on my credit cards. Debts will kill your chances at building wealth regardless of what you do for a living.

2: Follow your passion.

Though it sounds good on the surface, this is bad advice for most of us.

Here’s the problem: Your passion won’t pay your bills, but your strengths will.

Our passions often include creative outlets, like writing or woodworking. Photography. Maybe hiking in nature. While we might be passionate about these things, they tend not to help us pay our bills.

And even with then do, we risk killing those passions because we turned them into full-time jobs that we need in order to provide for our families. Very different ballgame.

Pursue a career that aligns with your strengths.

Maximize your earning potential.

3: Save 10% and you’ll be set.

This is largely outdated financial advice. Why?

- Life spans are lengthening

- Taxation is on the rise

- Jobs are changing

- Inflation

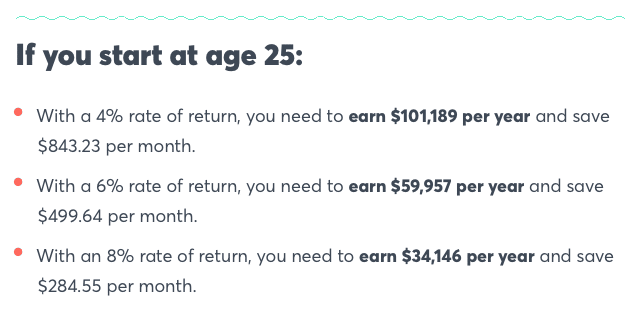

In fact, you might be surprised at how much money you’ll need to earn every year to make a 10% savings rate enough for a traditional retirement.

A standard 10% savings rate won’t cut it for most of us any longer. Fund your 401(k) and Roth IRA. Build an emergency fund. Aim to save and invest at least 20% of your paycheck.

Your future will thank you.

4: College is useless.

College graduates earn more than non-grads. Them’s the facts. Exceptions apply but never count on being an exception. Don’t allow people to talk you out of a smart career move.

Further, college doesn’t need to be as expensive as we tend to make it. Here are three ways to bring down the cost of college to a manageable level.

Go to a community college: The average yearly cost to attend a community college is only $4,800 for an in-state school, which is a mere fraction of the cost of a traditional 4-year university.

Instead of going straight to the 4-year school, start at a community college for two years, then jump over to a 4-year school to finish out your degree.

Go in-state: Believe it or not, those out-of-state schools aren’t necessarily “better” just because they are out of state. In-state makes college cheaper.

You will save 10s of thousands of dollars by going to an accredited in-state university for the same (or similar) degree. This theory applies to private schools as well. Don’t make yourself believe that you need that high-priced education.

Get a marketable degree: This tip won’t necessarily make college cheaper, but it may drastically shorten the time that it’ll take to earn back your money. Marketable degrees are degrees that companies are actively looking for and have high average salaries and good job prospects.

“But Steve, I’m not a computer person!“

Believe it or not, not all marketable degrees are technical.

A few examples of non-technical marketable degrees include:

- Marketing

- Nursing

- Economics

- Physical therapy

- Finance

5. You only live once.

In other words, “Spend your cash on temporary happiness crap“.

How about this: You only live once. Achieve FI and do whatever the heck you want for the rest of your life. That sounds much more satisfying to me.

6: Never use a credit card.

Using a credit card responsibly is one of the best ways to maximize your dollar. Why?

- Points

- Build credit

- Fraud protection

- Acquire airline miles

- Warranties on purchases

Let credit work for you.

Now, it is true that millions of people are deep in credit card debt. And, credit card debts tend to be very high interest. It’s one of the worst types of debts in existence.

As a result, it’s also true that credit cards need to be used with discretion. However, diligent use of credit cards has a wealth of benefits, making them a smart way to spend money provided you can stay out of credit card debt.

7. Renting is throwing your money away.

Homeownership is MUCH more expensive than people realize.

- Taxes

- Interest

- Maintenance

- Repairs

- Opportunity cost

Though owning your own home provides a wide range of financial benefits, renting gives you options that homeownership doesn’t, and it’s the right financial move for many people.

8: You gotta hustle 24/7.

This awful advice traps people into a life of burnout. Your rest and relaxation time is required to hustle. It’s healthy. Without rest, there’s no hustle.

9: There is no such thing as good debt.

Untrue. Smart debts pay off.

- Student loans

- Business loans

- Home equity loans

- Mortgages (sometimes)

“All debt is bad” is elementary school thinking. It’s just untrue.

10: Crypto is the future.

Nobody knows that. Not you. Not me.

Never take advice from people who believe they can predict the future. Ever.

11. Watching Netflix will make you poor.

Watching Netflix isn’t the issue. It’s a lack of motivation.

An unmotivated person who cancels Netflix will replace it with another distraction. You aren’t lazy or unmotivated because you watch Netflix.

Just keep it in moderation.

12: Read 5,000 books a year.

Reading is overrated. Doing is underrated. The marketplace does not care how many books you’ve read. It cares about what you can do. Stop stacking knowledge and start gaining experience.

13: Your credit score doesn’t matter.

It does. A good credit score means things are cheaper. What types of things?

- Car loans

- Mortgages

- Business loans

- Insurance rates

- Security deposits

And, don’t forget: Employers/landlords can check your credit.

14. Don’t worry about saving, just earn more.

This is a fallacy. The more you earn, the worse your spending problem gets if you don’t have it under control. You will NEVER be able to out-earn destructive spending habits. Ever.

15. Investing is gambling.

With gambling, your odds are not good. Investments, however, have a clear and direct history of making a LOT of people filthy rich.

- Not your salary

- Not your savings

- Not your upbringing

Your investments.